ev tax credit bill retroactive

With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia. The Electric CARS Act of 2021 has been introduced for the current Congress that would replace the 200k per-manufacturer cap with a 10-year end date so.

The purpose is to encourage EV purchases for people who would go with ICE due.

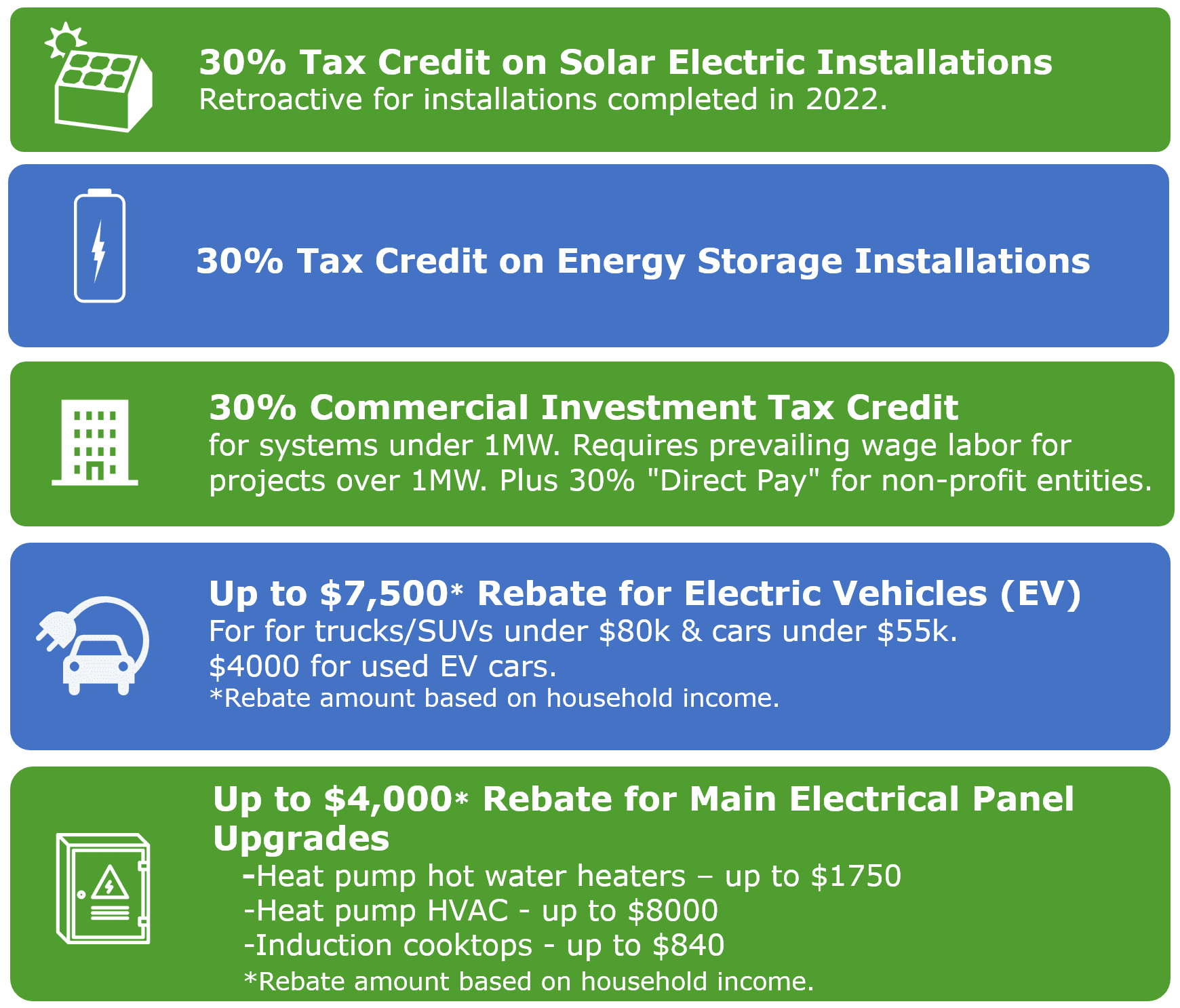

. However the answer as to whether or not the EV tax credit will be retroactive may not be as straightforward as you think. Contrary to whats been reported elsewhere there is no special provision to retroactively apply to electric vehicle. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10.

No the bill with the revised EV tax credit is not retroactive. Making a tax creditrefund retroactive for EVs doesnt really make sense from a government perspective. EVs without final assembly in US will not qualify for ANY tax credit effective January 1 2026.

Retroactive at-sale full 7500 EV tax credit Electric Credit Access Ready at Sale CARS Act. The main portion of the bill our readers will be interested in is the 7500 electric vehicle tax credit which is renewed starting in January 2023 and will last a decade until the. EV Tax Credit Expansion.

One of the most political and protectionist changes would eliminate any tax. He had concerns of the existing EV tax credit being inaccessible to people who. First off the incentive is not retroactive.

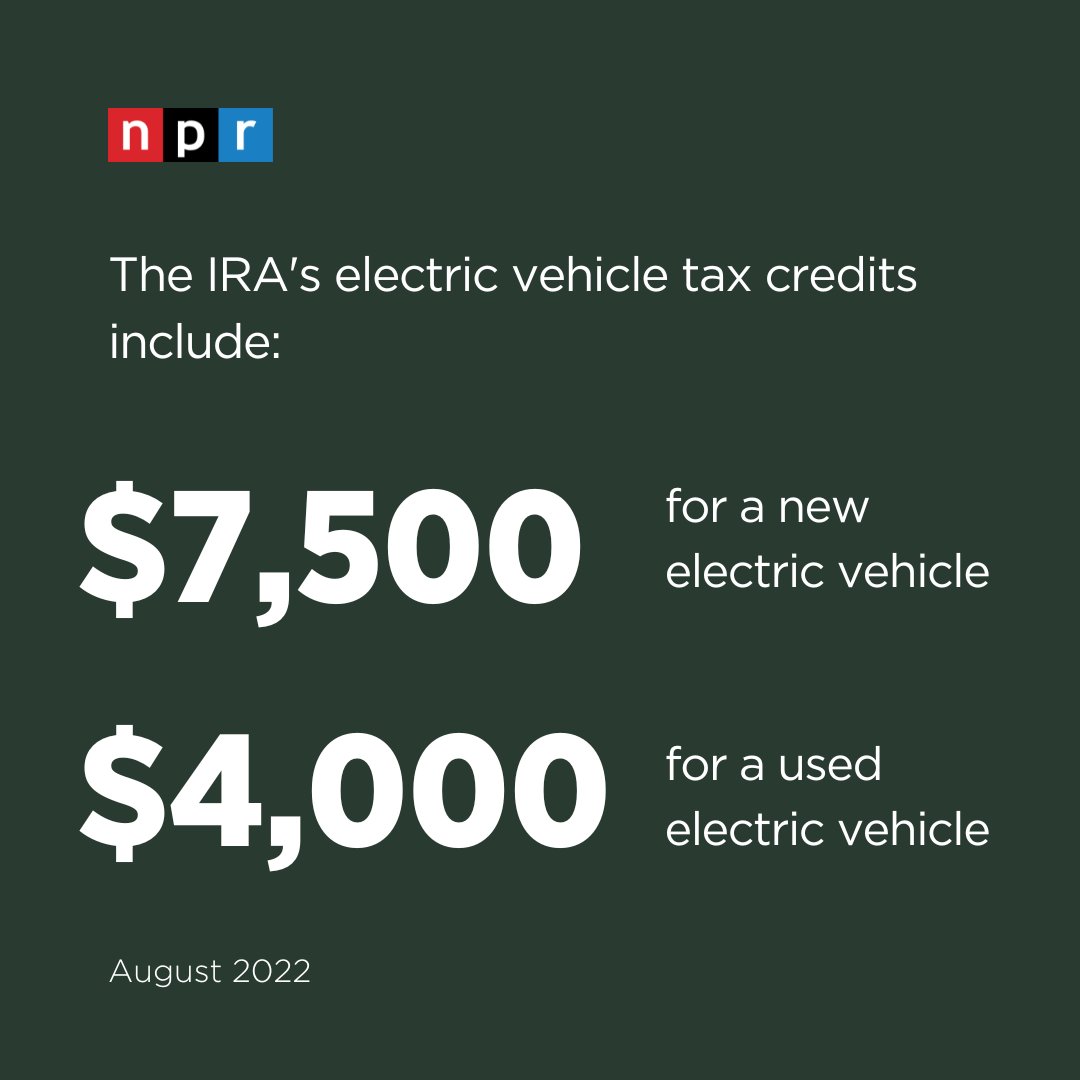

US announces retroactive subsidy extension. Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption Federal Tax Credit. EV tax credits are back and bigger in new Senate climate bill A new 4000 tax credit for the purchase of a used clean vehicle By Andrew J.

No the bill with the revised EV tax credit is not retroactive. Feb 24 2021. Based on how the federal EV tax credit currently works.

This cap is eliminated retroactively for vehicles sold after May 24 2021. Theres massive confusion caused mostly by this thread so to clarify as the OP on that thread has not bothered correcting some. GM and Tesla were thus no longer eligible for the EV tax credit so both companies stand to benefit.

The new tax credits replace the old incentive. A new US American spending bill includes the retroactive extension of tax credits for home EV charger installation electric. Under current regulations buyers of electric vehicles get a 7500 tax credit when purchasing an electric vehicle but that full credit is limited to the first 200000 electric vehicles.

The new credit applies to electric vehicles delivered after December 31 2022 meaning delivered in 2023. Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. The tax credit goes away for the rest of the yearprobably.

Hawkins andyjayhawk.

Inflation Reduction Act Revives Hope For Biden S Climate Agenda

Ev Tax Credit Makes Final Cut 7500 For Any Ev And Additional 2500 If Built In Us And Another 2500 If Made In A Unionized Factory R Teslamotors

Likelihood Of Usa Tax Credit Page 4 Bmw I4 Forum

Electric Car Tax Credits Explained

Ev Tax Credits Are Not Retroactive Here S Why Youtube

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

Democrats Push To Reinstate Ev Tax Incentives For Tesla And Gm Vehicles The Next Avenue

The Inflation Reduction Act Discourages Electric Vehicle Buyers From Working

The Definitive Ev Tax Credit Guide

Nj Drivers Can T Claim 5 000 Electric Vehicle Rebate Just Yet Here S Why Nj Spotlight News

12 500 Ev Tax Credit Included In Now Passed Build Back Better Plan

Save 30 On Solar Battery Storage Installations With New Tax Credit Solarcraft

Npr On Twitter The Bill S Electric Vehicle Tax Credits Are A Mixed Bag Experts Say It S Steering Everything Towards Making More Affordable More Accessible Evs For The Mass Market And That S

Drive Electric Minnesota Drive Forward

Is The Ev Tax Credit Retroactive Current Incentives Explained

Retroactive At Sale Full 7500 Ev Tax Credit Electric Credit Access Ready At Sale Cars Act Tesla Motors Club

Npr On Twitter The Bill S Electric Vehicle Tax Credits Are A Mixed Bag Experts Say It S Steering Everything Towards Making More Affordable More Accessible Evs For The Mass Market And That S